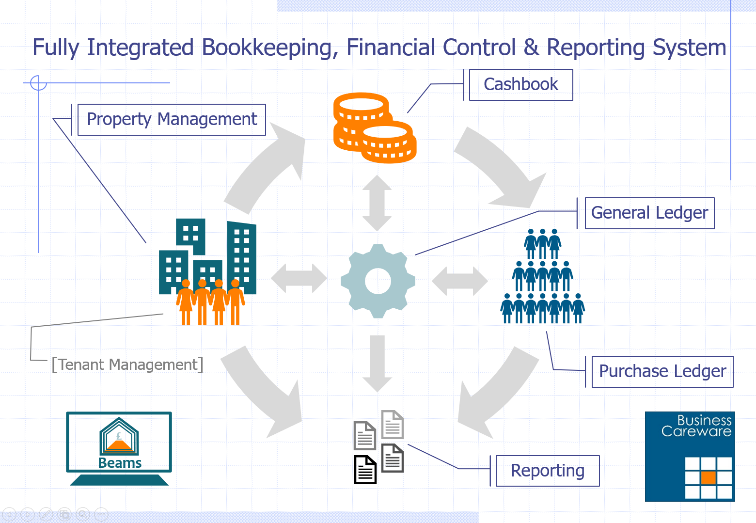

Flexible Multi-company Financial Management Built-in

From a financial management/control point of view it is a well-known fact that garbage in leads to garbage out.

That’s why Beams is designed to ensure that it is, and always remains, a garbage free zone.

With other systems you usually have to choose between property management functionality or accounting functionality, with Beams you don’t have to choose – you get the very best of both worlds.

Beams is a full property management system as well as a comprehensive, multi-company, multi-currency, multi-user bookkeeping, financial control and reporting system

The Property Management side of Beams provides the “missing” sales ledger. In fact, it does more than that by providing a trial balance, profit and loss account and balance sheet for each property, so that you can actually see the on-going and historical returns of each strategic asset individually – including detailed debtors analysis.

Looking at the other modules in turn…

Purchase Ledger

The Beams Purchase Ledger provides effective and highly-efficient purchase-to-pay functionality.

The Beams Purchase Ledger provides effective and highly-efficient purchase-to-pay functionality.

Unlike many other accounting solutions, the multi-company aspect is handled implicitly. In other words, the Beams purchase ledger provides a single, group-wide solution focused on receiving, approving and paying, when due, supplier invoices regardless of which company or which property they relate to.

This means that there is no requirement to pre-sort purchase invoices before logging in or having to sign in and out of companies in order to deal with queries across companies.

It also means that you can see the exact position of each suppliers’ account across the whole system, as well as by individual group or company.

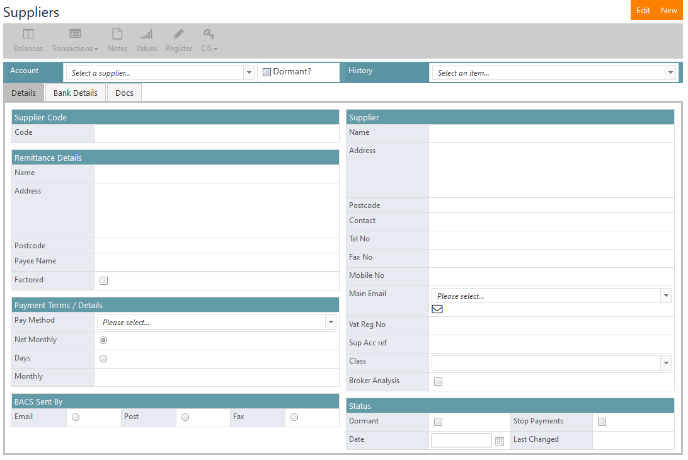

Supplier Data

As with tenants (debtors or customers), Beams holds all the necessary data for your suppliers (or creditors) to facilitate full and professional supplier payment management.

As with tenants (debtors or customers), Beams holds all the necessary data for your suppliers (or creditors) to facilitate full and professional supplier payment management.

With separate fields for legal and remittance addresses, supplier, payee and bank account names, your communication is pinpoint accurate. Indeed, Beams maintains a bank account history, allowing the same supplier to operate from more than one bank account.

Beams also incorporates CIS functionality to ensure that supplier invoices are processed and paid in full accord with HMRC regulations.

With a supplier selected, you have instant access to details of all balances outstanding, financial transactions, date and user tracked comments/actions Notes, monthly account values, transactions in the purchase invoice register (see below) and CIS information.

With a supplier selected, you have instant access to details of all balances outstanding, financial transactions, date and user tracked comments/actions Notes, monthly account values, transactions in the purchase invoice register (see below) and CIS information.

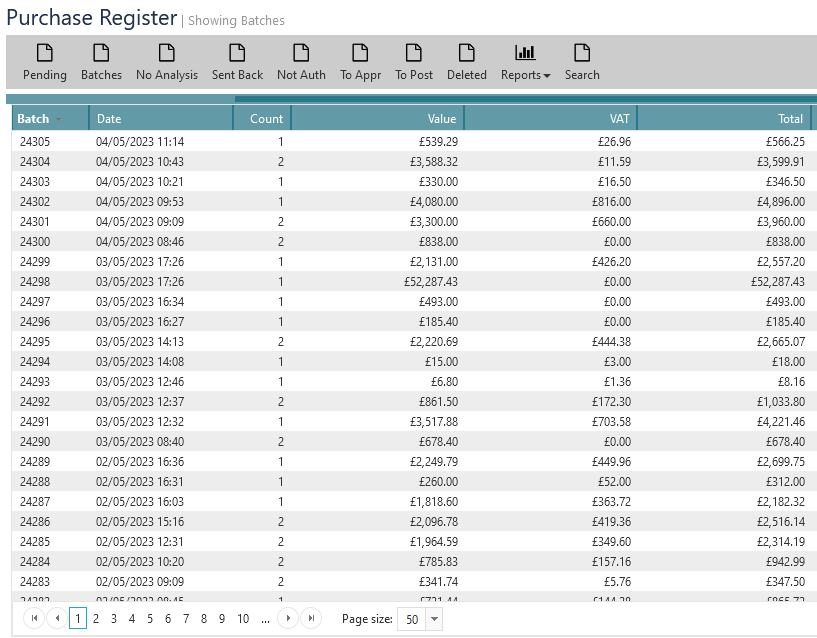

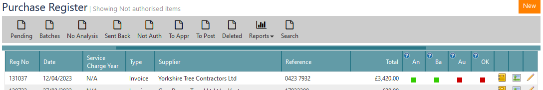

The Purchase Register

One of Beams’ main strengths, when it comes to maintaining the single version of truth, is the Purchase Register.

One of Beams’ main strengths, when it comes to maintaining the single version of truth, is the Purchase Register.

All purchase invoices are processed through the register, starting life as “pending” or unapproved.

There then follows a bespoke workflow whereby invoices (perhaps even specific invoice lines) are analysed (linked with a property or an individual unit where possible), arithmetically validated (e.g. is the unit price x quantity extended correctly, is the VAT calculation correct), authorised – often by a non-finance person (e.g. a surveyor or property manager), before being finance approved for posting, and subsequent payment.

The toolbar provides filters and editing facilities to really keep on top of ever single invoice, with one-click access to the document’s image and logs of all action taken so far.

The toolbar provides filters and editing facilities to really keep on top of ever single invoice, with one-click access to the document’s image and logs of all action taken so far.

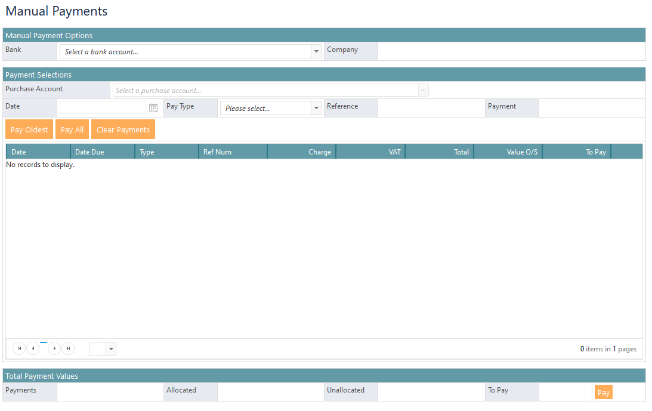

Manual Payments

It’s the way a system or process handles exceptions that shows its true worth and the (exceptional but often necessary) manual payments processing facility in Beams really does add value to the organisation by making it quick and easy to select exactly what it is you need to pay.

It’s the way a system or process handles exceptions that shows its true worth and the (exceptional but often necessary) manual payments processing facility in Beams really does add value to the organisation by making it quick and easy to select exactly what it is you need to pay.

It starts with the bank account to be used for the payment – where the use of a bank account for another group company automatically creates the intercompany double entry postings you would expect – before selecting exactly which item(s) are being settled, in part or in full.

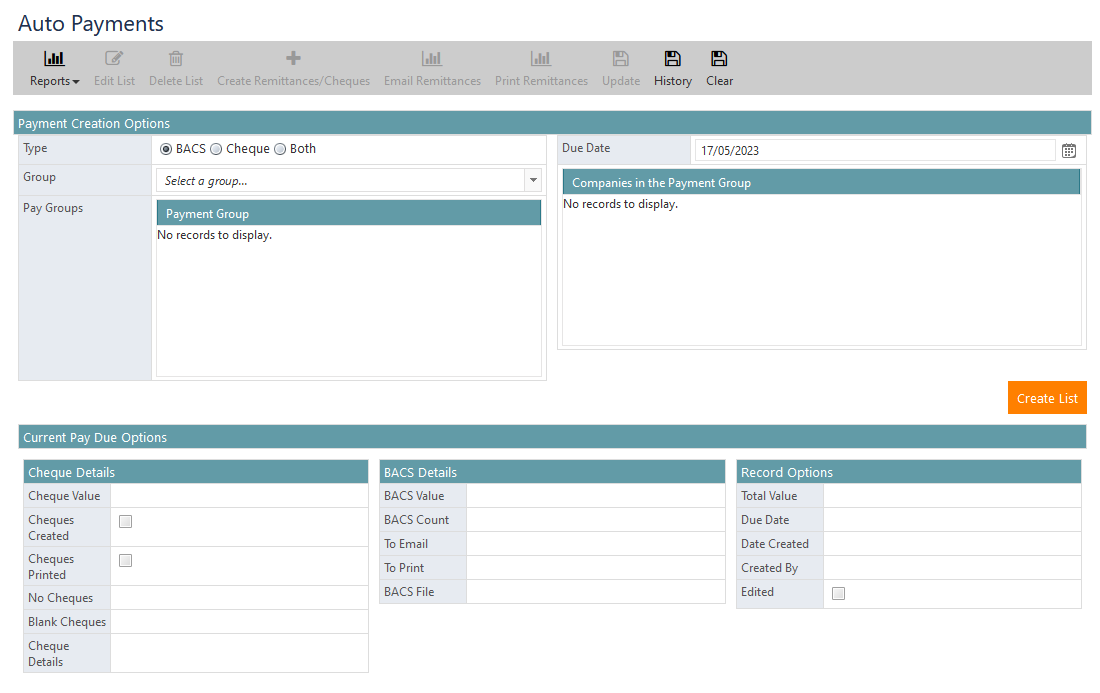

Auto Payments

This is where Beams processes 80% or more of your payments with much less than 20% of the effort.

This is where Beams processes 80% or more of your payments with much less than 20% of the effort.

Automatically finding purchase invoices that are already fully authorised, approved, posted, and due for payment, Beams allows you to create payment runs, which can then be reviewed and adjusted before being processed en-masse.

If/when you still need to produce cheques, there is full cheque printing controls, with cheque number tracking and a signature confirmation step.

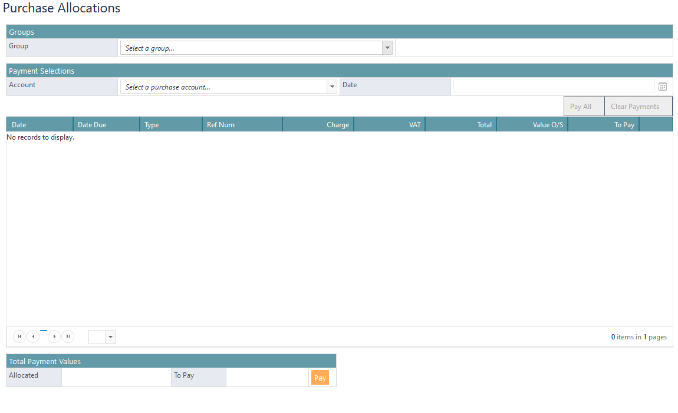

Allocations

Of course, the Beams payments processing functionality always accurately updates paid items to show them as either fully or partly matched, sometimes you have to make payments on account or receive credit notes to resolve supplier errors or disputes.

Of course, the Beams payments processing functionality always accurately updates paid items to show them as either fully or partly matched, sometimes you have to make payments on account or receive credit notes to resolve supplier errors or disputes.

This is where Allocations comes in.

With a simple selection process, you can quickly and easily find the transactions that you wish to match, net them off and the job is done!

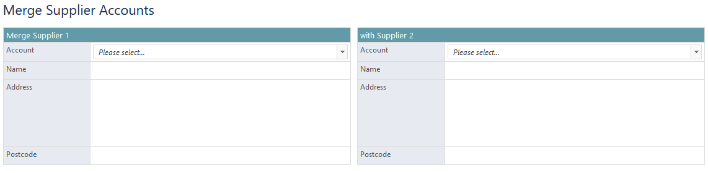

Merge Suppliers

Merge Suppliers is a simple yet useful feature of Beams. You can use it to keep your supplier list accurate, accommodating mergers and acquisitions (and correcting occasional human error).

Merge Suppliers is a simple yet useful feature of Beams. You can use it to keep your supplier list accurate, accommodating mergers and acquisitions (and correcting occasional human error).

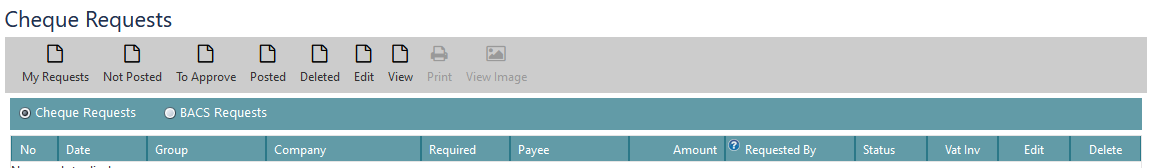

Payment Requests

Another example of providing a slick system for all stakeholders is Payment Requests. No more emails or post-it notes – any authorised member of staff can request a payment to be made via Beams. The system even keeps track of the progress of their request, showing progress on the Payment Request screen.

Another example of providing a slick system for all stakeholders is Payment Requests. No more emails or post-it notes – any authorised member of staff can request a payment to be made via Beams. The system even keeps track of the progress of their request, showing progress on the Payment Request screen.

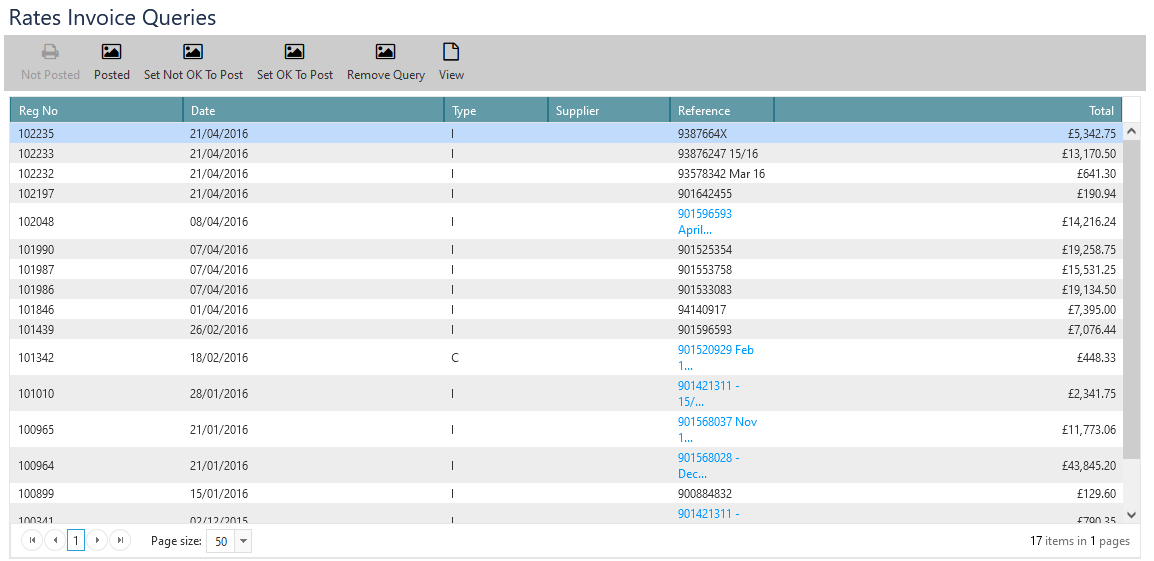

Rates Invoice Queries

A common problem faced by all property companies in the UK is dealing with local authorities and their demands for payment of Business Rates.

A common problem faced by all property companies in the UK is dealing with local authorities and their demands for payment of Business Rates.

Beams provides special functionality to record Business Rates details against purchase invoices in the Purchase Register, and separate and specific functionality to manage and resolve queries and disputes.

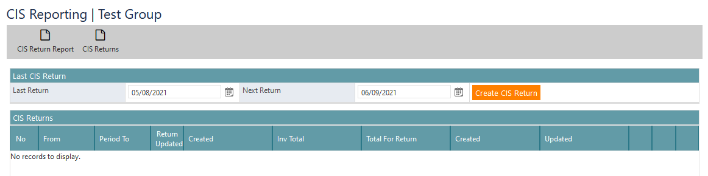

CIS Returns

Working very much like VAT Returns, Beams makes the monthly CIS return process robust, logical and simple.

Working very much like VAT Returns, Beams makes the monthly CIS return process robust, logical and simple.

With full historic returns tracking and comprehensive reporting, the burden of CIS is reduced to a trivial level.

General Ledger

Whether you know it as the “general” or the “nominal” ledger, it serves the same purpose – to support the production of profit and loss statements and balance sheets and all the supporting analysis and investigation that goes with them.

Whether you know it as the “general” or the “nominal” ledger, it serves the same purpose – to support the production of profit and loss statements and balance sheets and all the supporting analysis and investigation that goes with them.

The Beams General Ledger has been refined through the fire of daily, monthly, quarterly and annual activities of some of the UK’s leading property management companies meaning that you can rely on it completely. It also supports external audit use too.

As with the rest of Beams, access is controlled through user permissions, ensuring that the right people have access to the right data and functionality as and when needed.

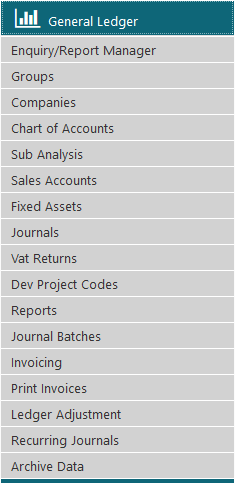

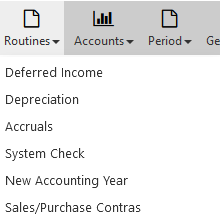

You can see from the General Ledger top-level menu that it is extensive and rich in functions and features.

Enquiry/Report Manager

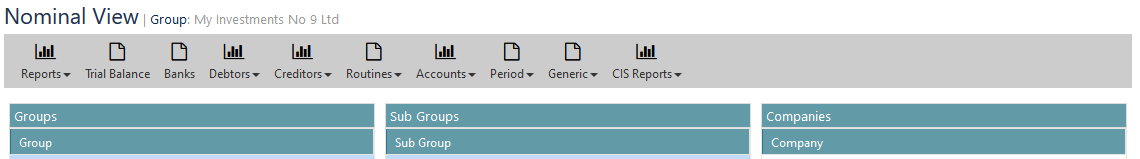

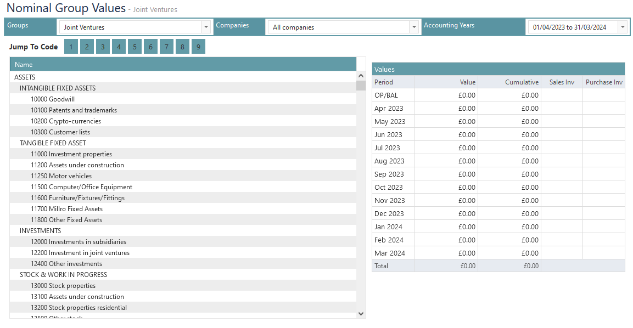

The Enquiry/Report Manager is your first glance at the true power of Beams’ multi-company structure.

All reports can be run at group, sub-group or individual company level.

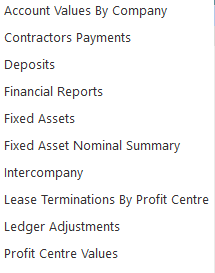

The list of standard reports that are available shows the tightly integrated nature of the General Ledger with the property management focus of the system, with Contractors Payments, Deposits, and Lease Terminations By Profit Centre amongst those itemised.

The list of standard reports that are available shows the tightly integrated nature of the General Ledger with the property management focus of the system, with Contractors Payments, Deposits, and Lease Terminations By Profit Centre amongst those itemised.

Of course, you can add others that you define to this list as required.

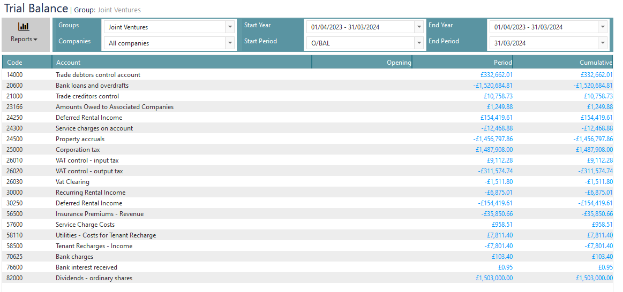

Trial Balance

The Beams Trial Balance is a live/interactive screen that allows you to view movements for a single or across multiple accounting periods, even years, with context sensitive drill down/through to retrieve the detail for each row.

The Beams Trial Balance is a live/interactive screen that allows you to view movements for a single or across multiple accounting periods, even years, with context sensitive drill down/through to retrieve the detail for each row.

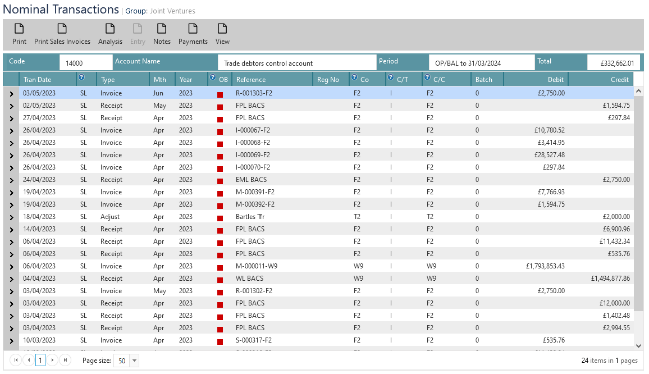

When you click-through to the Nominal Transactions listing screen you are not only able to see the individual items that make up the movement in the account over the timeframe selected, but also “print” the transactions (with export to MS Excel and MS Word and email options), retrieve copies of the sales or purchase invoices featuring in the list (as well as payments received/made), view the double entry postings of and any notes held on the system each item.

When you click-through to the Nominal Transactions listing screen you are not only able to see the individual items that make up the movement in the account over the timeframe selected, but also “print” the transactions (with export to MS Excel and MS Word and email options), retrieve copies of the sales or purchase invoices featuring in the list (as well as payments received/made), view the double entry postings of and any notes held on the system each item.

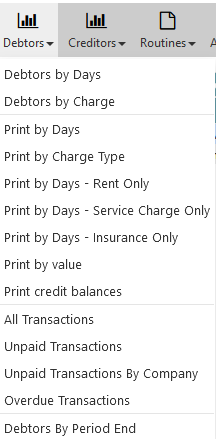

Debtors

Selecting the Debtors option reveals an Aladdin’s cave of credit control treasures.

With ‘dice and slice’ views of debtors by age or charge type, exportable on-screen reports of debtors by days, by charge type, for Rent Only, Service Charge Only, and Insurance Only, plus a handy view ranked with the highest value outstanding first – you can not only expedite the collection of cash but also manage your exposure and risk.

The transactions reports make it quick and easy to get a picture of historical debtor account behaviour, helping spot trends and helping you get ahead.

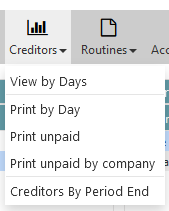

Creditors

Reflecting the simplicity that Beams brings to purchase ledger and creditor management, the Creditors options are much fewer in number than for debtors.

View by Days is a simple, company by company listing of creditor control account balances aged in periods across the screen with drill-through by company right down to the detail of every original purchase transaction(s). The display also offers printable versions of the top-level on-screen view.

The print options provide further information and analysis, which can also be exported to MS Excel and MS Word or emailed, as required.

Routines

Providing a home for important but infrequently undertaken tasks, Routines allows authorised users to calculate Deferred Income for selected charge types, e.g. rental paid in advance, showing the results as a preview which can then be reviewed and modified as required to ensure that a true and accurate view can be created for each company.

Providing a home for important but infrequently undertaken tasks, Routines allows authorised users to calculate Deferred Income for selected charge types, e.g. rental paid in advance, showing the results as a preview which can then be reviewed and modified as required to ensure that a true and accurate view can be created for each company.

Depreciation creates previews of depreciation schedules which can be posted or reviewed and adjusted as required prior to posting.

Accruals finds unposted items from the Purchase Register and offers them for month end/year end accrual.

There is even a Routine to match Sales Account transactions with Purchase Ledger transactions – handy when your suppliers are also your tenants and you need to create a net debtor/creditor position with them.

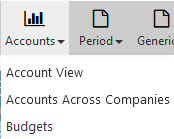

Accounts

Accounts is the place where you can browse your live balance sheets and profit and loss accounts within the framework of the group structure of your companies.

Accounts is the place where you can browse your live balance sheets and profit and loss accounts within the framework of the group structure of your companies.

Accounts Across Companies is used to keep track of and confirm intercompany transactions.

This is also where you enter our budgets for reporting and control purposes.

Account View

Using the fabulously simple yet powerful Beams hierarchical chart of accounts structure, you can navigate your trial balance and then drill-down into the Nominal Transactions screen to see the details of what the balance is made up of and drill-down further to see analysis, notes and original transactions and their source documents.

Using the fabulously simple yet powerful Beams hierarchical chart of accounts structure, you can navigate your trial balance and then drill-down into the Nominal Transactions screen to see the details of what the balance is made up of and drill-down further to see analysis, notes and original transactions and their source documents.

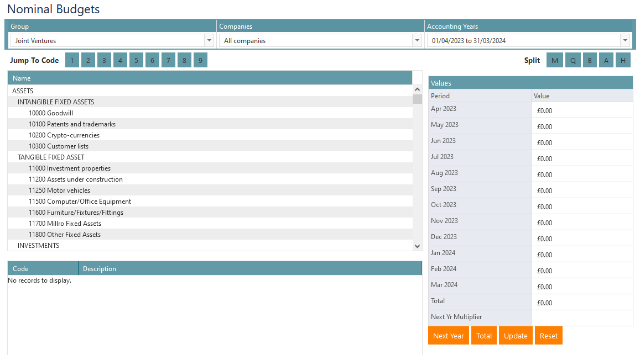

Budgets

The Beams Budgets tool is designed to take the strain and need for spreadsheets out of the budgeting exercise.

The Beams Budgets tool is designed to take the strain and need for spreadsheets out of the budgeting exercise.

Using the familiar trial balance navigator, you are able to input values which can then be split by month (i.e. one 12th per month), quarterly, half-yearly, budget amounts input manually as/when expected or held as a single annual amount.

Values can also be generated as a multiplier of the previous year’s actual figures, be that greater, less than or equal to 1.

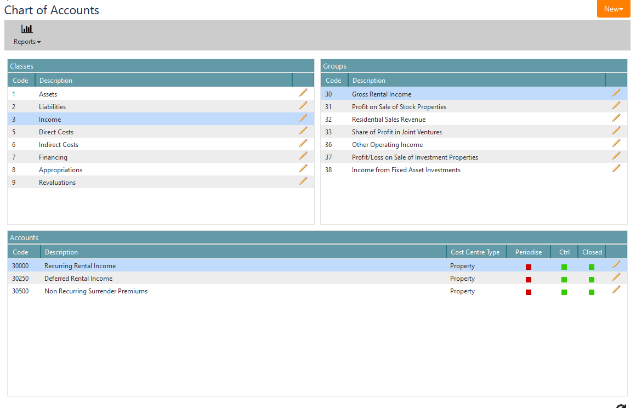

Chart of Accounts

Beams uses a five digit, three-level structured approach to the chart of accounts with the same structure used for all groups and all companies across the system, ensuring consistency of reporting and posting.

Beams uses a five digit, three-level structured approach to the chart of accounts with the same structure used for all groups and all companies across the system, ensuring consistency of reporting and posting.

At the third level, accounts are linked to cost centres and marked as being active or not and, for selected balance sheet accounts, where they are control accounts.

Of course, you are not limited to just one dimension of posting classification with a free-format, powerful, “departmental” sub-analysis available for use either on a company-by-company basis or across your whole system.

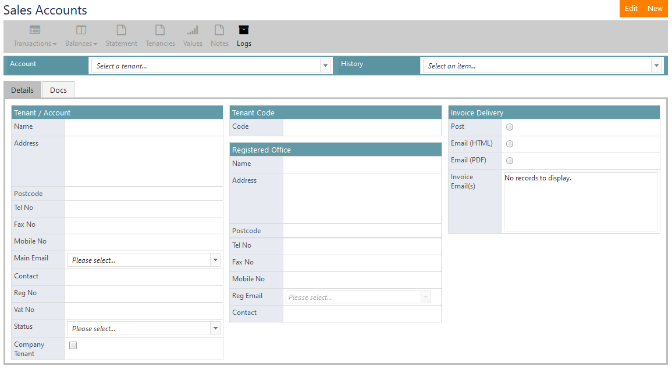

Sales Accounts

Recognising that not everyone that you sell to is a tenant in one of your properties, Sales Accounts allows you to create and maintain non-tenant accounts for such “customers”

In practice the data is held in the same place as it is for tenants, and properly authorised finance staff are able to manage and report on tenants and non-tenants alike through the Sales Accounts screen.

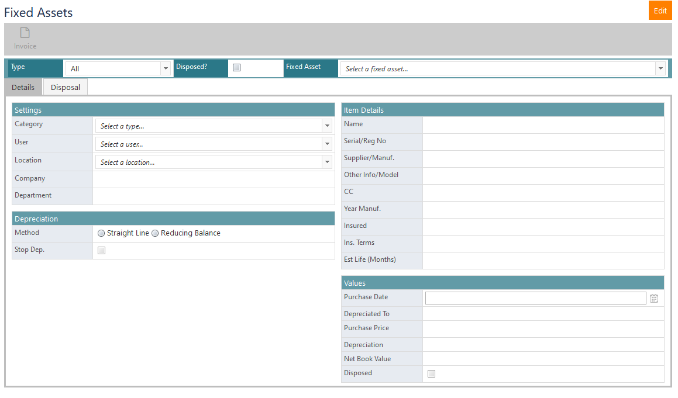

Fixed Assets

The Fixed Asset system in Beams is designed to help keep track of and calculate depreciation for non-property fixed assets, e.g. computers or motor vehicles.

Offering a choice of straight line or reducing balance methods of depreciation and supporting a flexible but structured approach to classifying your fixed assets, the system means that you can account for all your assets in one place – Beams.

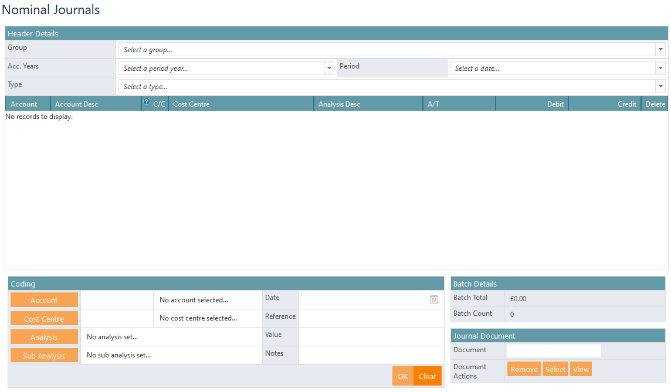

Nominal Journals

The Beams Nominal Journals functionality is designed to work with you and your operating policies and levels of authorisation.

Within those constraints, you can use Nominal Journals to create postings to all nominal accounts as required to ensure that your accounts are fully compliant with both external and internal accounting standards and requirements.

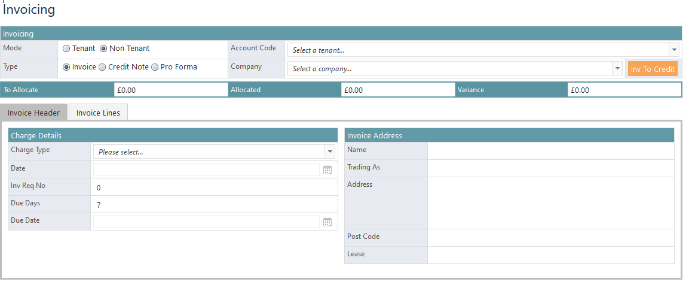

Invoicing

General Ledger Invoicing is designed to handle all those odds and ends of 3rd party charging that crop up with unwelcome frequency.

Linking to Sales Accounts and/or Tenants, the system allows you to create invoices, credit notes and pro-forma invoices (requests for payment), using a simple yet flexible header and single or multiple lines structure, which means that you are free to invoice just the way you want.

You can also easily create credit notes from existing invoices, when the need arises.

Cash Book

The Beams Cash Book is the final, and arguably most important, piece in the accounting jigsaw.

The Beams Cash Book is the final, and arguably most important, piece in the accounting jigsaw.

Its primary function is to support bank reconciliations, importing transactions from your bank accounts and either matching them with transactions generated by Beams, e.g. supplier payments, or seamlessly entering them into Beams without the need for manual data entry – with all the issues that it entails.

It is also home to some credit control functionality, such as statements, final demands and arrears recovery activity.

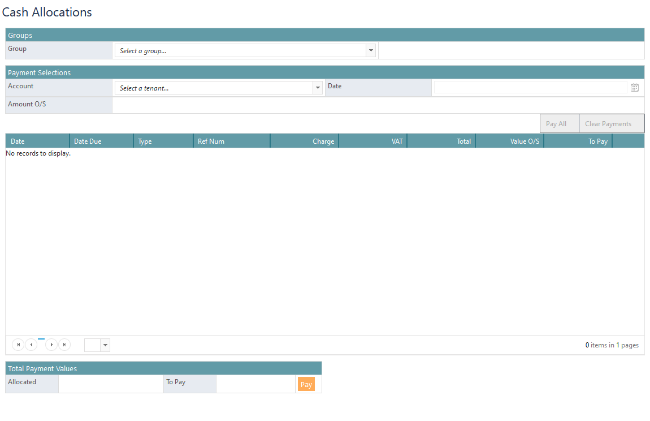

Allocations

Cash Allocations is the process of matching receipts with invoices/requests for payment.

Cash Allocations is the process of matching receipts with invoices/requests for payment.

Beams will try to automatically allocate receipts where it can, thereby only requiring the guiding hand of a human being where there isn’t a clear link between items outstanding and amounts received.

Even then Beams makes it as easy as possible by allowing users full control of whether items are paid, part-paid or remain fully outstanding and providing on-screen check totals of how much has been and is still to be allocated.

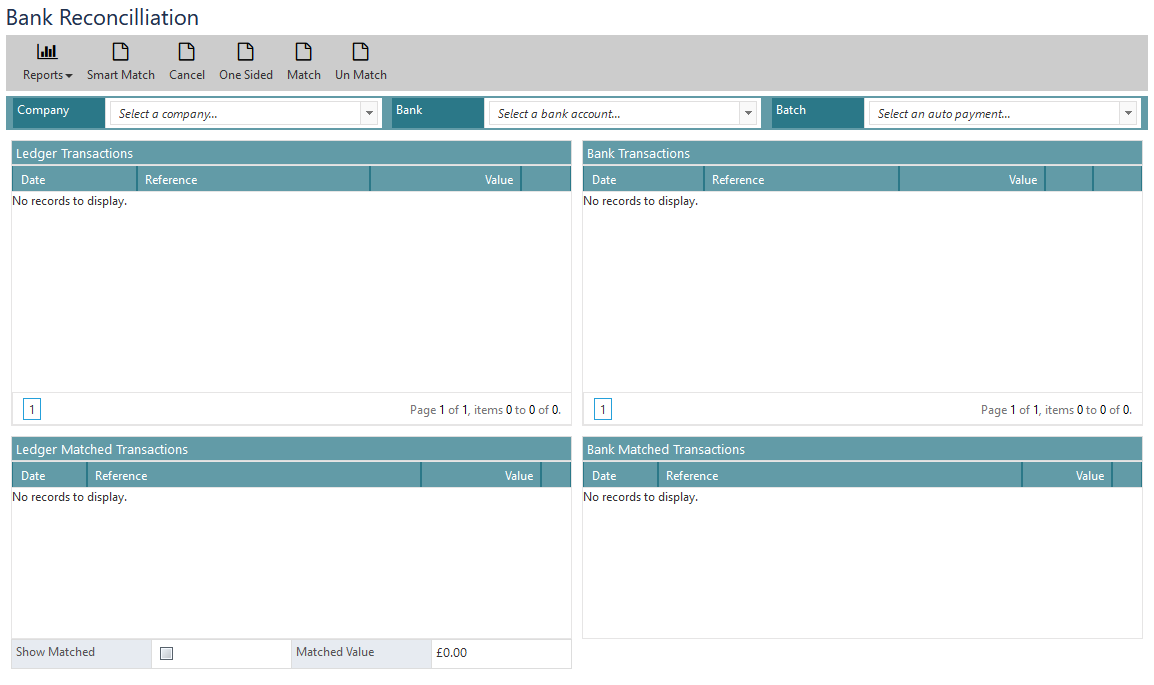

Bank Reconciliations

The Beams Bank Reconciliation functionality provides and effective and efficient means of achieving what can sometimes be a longwinded and taxing exercise.

The Beams Bank Reconciliation functionality provides and effective and efficient means of achieving what can sometimes be a longwinded and taxing exercise.

With a screen that clearly shows unmatched ledger and bank transactions side by side above respective matched items and featuring Smart Match functionality, allowing the system to match as many items as possible, users find that reconciling bank accounts using Beams is as simple and straightforward as it could be.

Hopefully, this has given you a good idea of the tightly integrated bookkeeping and accounting functionality that Beams offers. However, this is only the tip of the iceberg of Beams capabilities.

Please contact us to discuss your own situation and business needs so that we can show you how Beams can change your world for good.